IRF Industry Outlook for 2022: Positive Signs, With Some Buts...

The Incentive Research Foundation “Industry Outlook 2022 Study for Merchandise, Gift Cards and Event Gifting” has generally positive news subject to the continued state of flux due to the pandemic. The bad news is that the majority of buyers continue to purchase awards and related services through retail channels.

- Stronger Financial Performance Projected, Despite Program Cancellations

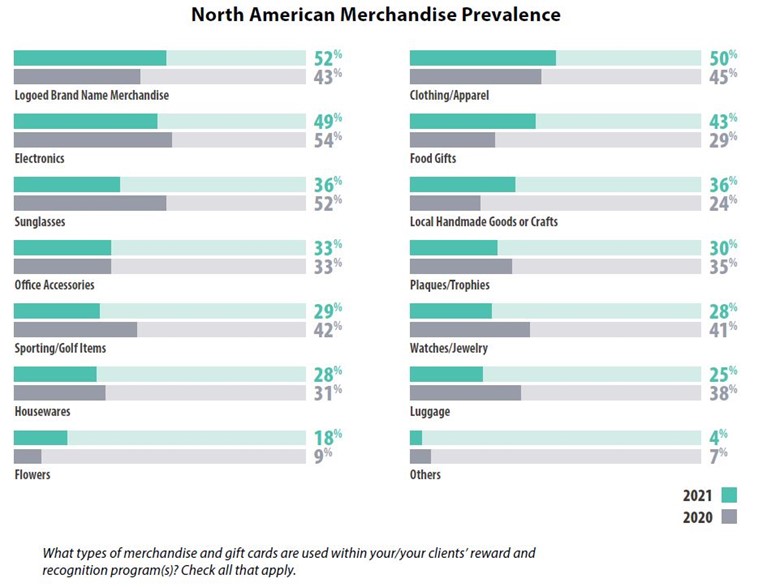

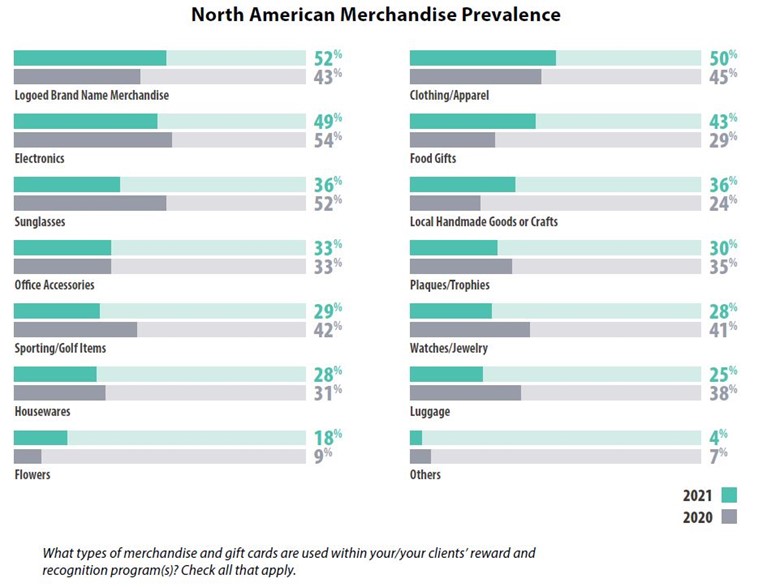

- Brand Name Merchandise, Clothing, Electronics Top North America Lists

While there is general optimism about market growth on both sides of the Atlantic, one of the most striking findings in this recent Incentive Research Foundation study of 481 North American and European end-users, incentive and recognition companies, and a few suppliers, is the large percentage of companies that still buy from retailers for their merchandise, gift cards, and event gifting.

In 2021, 65% of respondents indicated that companies purchase gift cards from retailers, up from 61% last year; 82% of Europeans source gift cards at retailers.

In 2021, 65% of respondents indicated that companies purchase gift cards from retailers, up from 61% last year; 82% of Europeans source gift cards at retailers.

The survey results are based on 481 responses, with 275 coming from North America and 206 originating from Europe. The study included respondents from corporate clients, third-party incentive agencies and a small number of merchandise and gift cards suppliers.

According to Rick Garlick, Chief Research Officer for the IRF, only 36% of US respondents use an incentive company, marketing agency, or consulting company, up from 28% in 2020. And more companies in the US purchase merchandise for event-gifting online than they do through the industry. “In 2021, corporate sales have fallen behind online retailers as the primary purchase source. Compared to North Americans, Europeans are much more likely to purchase event gifts from online retailers and event sponsors. North Americans are more likely to purchase from destination management companies and corporate sales,” the report says.

Stronger Financial Performance Projected, Despite Program Cancellations

For both North American and European respondents, 78% agree or strongly agree that they expect their companies to have stronger financial performance next year. This represents a significant rebound from the previous year, when only 64% of North Americans foresaw a strong financial performance for their companies in 2021. Two-thirds (63%) of North Americans believe the US economic outlook is strong for 2022, compared with only 50% who felt similarly going into 2021.

This economic optimism exists even though there was a large increase in merchandise and gift card program cancellations in 2021, according to Garlick. The percentage of cancellations rose from 29% in 2020 to 44% in 2021. The percentage canceling merchandise programs in Europe this past year was even higher, with 66% of Europeans reporting canceled programs.

Asked why so many merchandise companies appear to be having good years despite the numbers above, Garlick suggests the conflicting numbers may be explained by the fact that respondents are referring to merchandise gifting programs canceled along with travel programs. In some cases, this may reflect responses from companies that had moved away from travel to merchandise during the first year of the pandemic then began to swing back to travel this year, only now to be reconsidering 2022 plans because of the latest Covid variant.

.

On the plus side is an intention to spend more money per person on non-cash reward and recognition programs, according to the report. “Last year, the reported average spent per person was $764; this year it has increased to $806. More importantly, 51% plan to spend more than $250 per person, where last year only 41% planned to spend more than $250 on each individual.”

Brand Name Merchandise, Clothing, Electronics Top North America Lists

Logoed brand-name merchandise, along with clothing and electronics, are the most popular in North America in the 2021 study. The use of open-loop and restricted gift cards declined in 2020. While 2021 open-loop card use was still down quite a bit from 2019 levels, the use of restricted cards rebounded to pre-pandemic use levels. Europeans are much more likely to use restricted-use cards and vouchers compared to North Americans.

North Americans are far more likely to give ‘big box’ retailer cards, as well as coffee cards. Europeans, are much more likely to give gift cards for accessories and jewelry, as well as gift cards for beauty products, travel, and grocery.

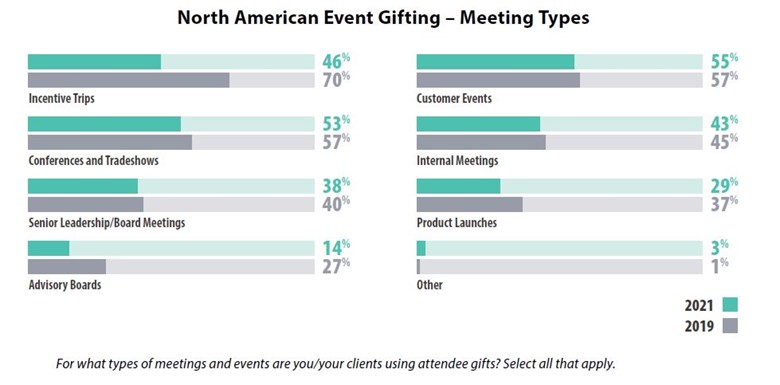

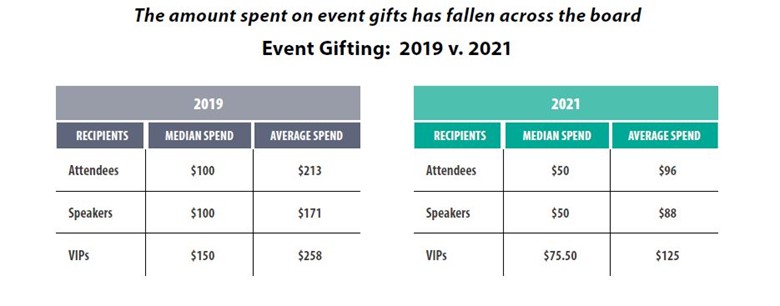

In the event gifting field, “the prevalence of items custom-made or fitted on-site decreased dramatically from 72% to 49%, offsetting an increase from 2018 to 2019 (59% to 72%.) A new category, gift cards, received 37% mention, nearly as high as local food and beverage (39%). Europeans are most likely to give locally relevant goods and crafts as gifts, and less likely to give nationally recognized brand merchandise and gift cards, compared to North Americans. Sponsorships of event gifts seems to be declining around merchandise donations, going down from 25% in 2019 to 14% in 2021. Europeans do much better at getting sponsorship fees and discounts to pay for event gifts.”

In North America, 77% of respondents indicated they allow brand representatives to engage with attendees. It is a near-universal practice in Europe, with 90% using this practice.

Both North Americans and Europeans are most likely to give electronics and clothing/apparel as merchandise gifts. However, North Americans place a much higher emphasis on logoed brand merchandise, while Europeans are more likely to give office accessories as a gift. The average value of a merchandise reward is $152, roughly the same as the previous two years. The percentage that spent $100 or less on merchandise was the same as a year ago, 47%.

Education, Certifications, and Information to Activate

A complete learning, certification, and information program and a course syllabus for educators.

Education, Certifications, and Information to Activate

Brand Media and Enterprise Engagement

A complete learning, certification, and information program and a course syllabus for educators.

Resources: The Brand Media Coalition, the only guide to the story-telling power of brands and where to source them for business, event, promotional gifting, and rewards and recognition. Enterprise Engagement Solution Provider Directory. The only directory of engagement solution providers covering all types of agencies and tactics as well as insights on how to select them.

Communities: The Enterprise Engagement Alliance and Advocate and the Brand Media Coalition free resource centers offering access to the latest research, news, and case studies; discounts, promotions, referrals, and commissions, when appropriate to third-party solution providers from participating coalition solution provider members.

Training and Certification

Enterprise Engagement Alliance Education: Certified Engagement Practitioner; Advanced Engaged Practitioner, and Certified Engagement Solution Provider learning and certification programs on how to implement Stakeholder Capitalism principles at the tactical level.

International Center for Enterprise Engagement: The only training and certification program for ISO 30414 human capital reporting and ISO 10018 quality people management certification.

The EEA offers a complimentary course syllabus for educators.

In Print:

This is the definitive implementation guide to Stakeholder Capitalism, written specifically to provide CEOs and their leadership teams a concise overview of the framework, economics, and implementation process of a CEO-led strategic and systematic approach to achieving success through people. (123 pages, $15.99)

The first and most comprehensive book on Enterprise Engagement and the new ISO 9001 and ISO 10018 quality people management standards. Includes 36 chapters detailing how to better integrate and align engagement efforts across the enterprise. (312 pages, $36.)

Online:

10-minute short course: click here for a 10-minute introduction to Enterprise Engagement and ISO standards from the Coggno.com learning platform.

Services:

• The Engagement Agency at EngagementAgency.net, offering: complete support services for employers, solution providers, and technology firms seeking to profit from formal engagement practices for themselves or their clients, including Brand and Capability audits for solution providers to make sure their products and services are up to date.

• C-Suite Advisory Service—Education of boards, investors, and C-suite executives on the economics, framework, and implementation processes of Enterprise Engagement.

• Speakers Bureau—Select the right speaker on any aspect of engagement for your next event.

• Mergers and Acquisitions. The Engagement Agency’s Mergers and Acquisition group is aware of multiple companies seeking to purchase firms in the engagement field. Contact Michael Mazer in confidence if your company is potentially for sale at 303-320-3777.

Enterprise Engagement Benchmark Tools: The Enterprise Engagement Alliance offers three tools to help organizations profit from Engagement. Click here to access the tools.

• ROI of Engagement Calculator. Use this tool to determine the potential return-on-investment of an engagement strategy.

• EE Benchmark Indicator. Confidentially benchmark your organization’s Enterprise Engagement practices against organizations and best practices.

• Compare Your Company’s Level of Engagement. Quickly compare your organization’s level of engagement to those of others based on the same criteria as the EEA’s Engaged Company Stock Index.

• Gauge Your Personal Level of Engagement. This survey, donated by Horsepower, enables individuals to gauge their own personal levels of engagement.

For more information, contact Bruce Bolger at Bolger@TheEEA.org, 914-591-7600, ext. 230.