IRF Study: All Systems Go for IRR Market 2023

All aspects of the Incentive, Rewards, and Recognition (IRR) market are growing except for industry awareness, according to the study: Industry Outlook for 2023: Merchandise, Gift Cards And Event Gifting. Spending on both sides of the Atlantic is expanding for merchandise, gift cards, and event gifting but significant volume continues to move through retail channels.

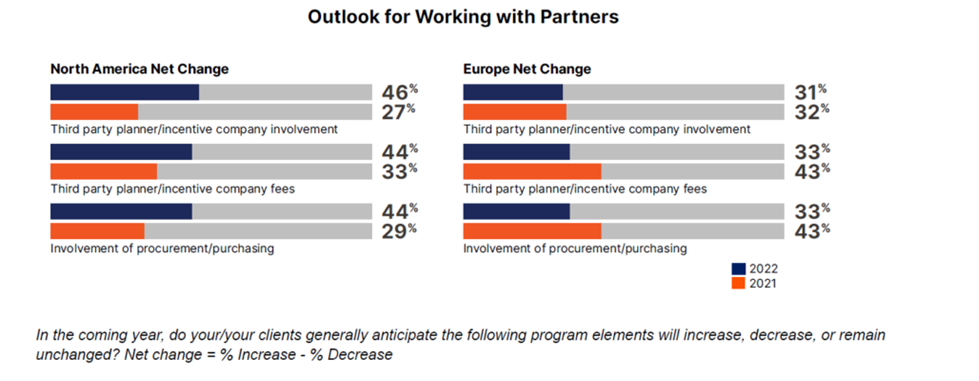

In this vein, the study raises a red flag for industry suppliers. “Online retailers continue to show very strong growth as a source of event gifts in North America. In 2019, corporate sales were easily the most common source of purchasing event gifts. In 2021, corporate sales fell behind online retailers as the primary purchase source, and now the gap has grown even larger (63% for online retailers to 34% for corporate sales.) The study does show a significant increase in the anticipated use of incentive companies by end-users in the US, up to 46% from 27%, but little change in Europe at about 31%.

Here is a summary of other key findings:

Financial optimism. Of the North American respondents, 88% agreed that their company will have strong financial performance in 2023, including nearly half (47%) who ‘strongly agree.’ European belief in the financial outlook for their companies is also positive with 82% agreeing their companies’ financial outlook in 2023 is positive. However, only 30% in Europe strongly agree with this statement.

A positive regulatory environment. The study finds that most look with positivity toward the current regulatory environment in both North America and Europe. Fifty-two percent (52%) of North American respondents believe the regulatory environment would have a positive impact on non-cash recognition programs, while only 13% feel the regulatory environment will impact programs in a negative way. The results are comparable in Europe, with 49% predicting a positive impact and only 14% predicting a negative impact. This study was conducted before the European Parliament approved the new Corporate Sustainability Reporting directive, which requires most EU companies with 250 or more employees and their suppliers and distribution partners that support them to disclose detailed information on the composition and management practices of their own workforces; those of their channel and supply partners, as well as their customer and community engagement practices.

Supply chain issues improve. Over half (53%) believe the supply chain will have a positive impact on non-cash programs in 2023, compared to only 20% who believe it will have a negative impact. Europe is just as positive with an identical 53% believing the supply chain will have a positive impact, compared to only 16% who believe the supply chain impact will be negative.

.

Program cancellations remain high, but the rate is receding. The percentage that cancelled gift card/merchandise programs declined in North America from 44% in 2021 to 37% in 2022. While this still represents a high number, it represents improvement. In Europe, nearly half (48%) of the survey respondents reported discontinuation of at least one merchandise or gift card program. Although this seems discouraging, the percentage of cancellations declined significantly from 2021, when 66% reported a program cancellation.

Inflation encourages use of non-cash rewards. In North America, 50% of respondents believe inflation increases the perceived value of non-cash incentives, double the percentage (23%) who believe inflation makes non-cash incentives less valuable. Europeans, however, are more divided about how inflation influences the value of non-cash rewards, with 38% saying inflation makes them more valuable and 29% believing non-cash rewards are less valuable due to inflation.

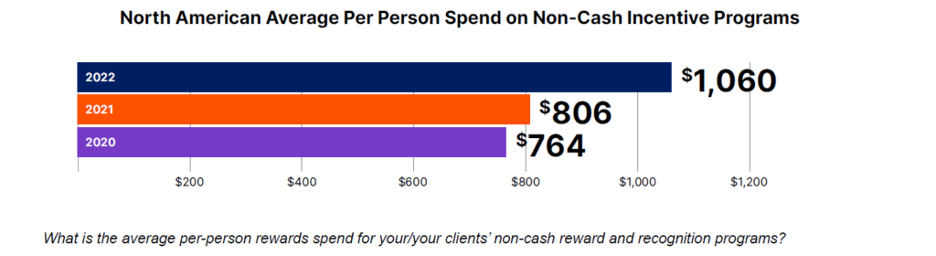

A positive budget outlook. The largest cause for the projected net increase in budgets is because of growth in the number of anticipated participants earning a reward, where 61% indicate this budget will increase as opposed to only 10% who expect a decrease in the number who will earn a reward. The study shows that the average per-person spend on North American for non-cash rewards continues to rise. In 2022, the average per-person spend was reported to be $1,060 compared to $806 in 2021. Fifty-eight percent spent more than $250 per person, compared to 51% the previous year. In Europe, the average amount spent per person on non-cash rewards is 650 Euros ($690.) Only 43% of European organizations spend more than 250 Euros ($265). While the overall outlook for non-cash rewards in Europe remains strong, the report finds, it is not as strong as in North America: 52% anticipate an overall increase in their reward and recognition program budgets, while 19% anticipate a budget decrease. In Europe, gift card and technology budgets appear to have the largest anticipated increases for 2023. While not quite as strong as North America, merchandise spending in Europe also shows a net positive gain in 2022 compared to last year when it showed a slight net decline.

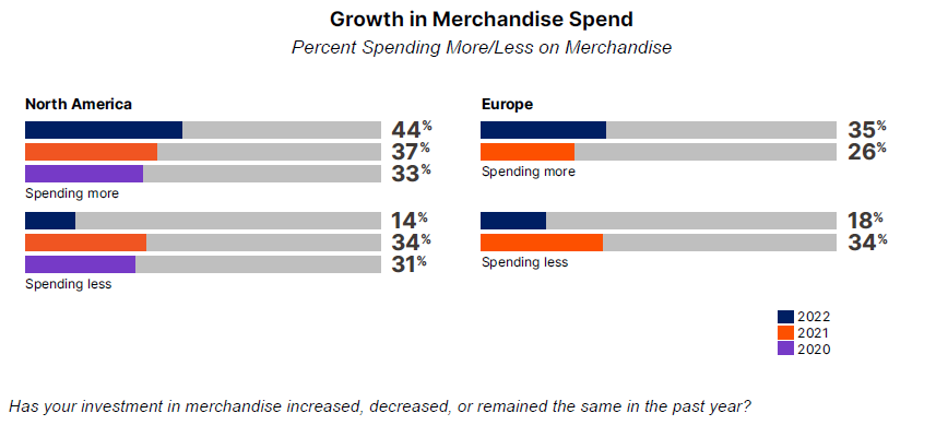

Merchandise gifts continue to grow. North American spend on merchandise has grown, with 44% saying their merchandise spending increased in the past year compared to only 14% who said they spent less. The net increase has grown significantly since 2020 when many incentive programs switched from travel to merchandise and gift cards as rewards. The average value of a North American merchandise reward is $191, up from $152 last year, and up from the previous three surveys, which showed $160 in each year. The percentage of North Americans that spent over $100 has increased from 53% to 64%. The European average merchandise value was 152 Euros ($161.) In the case of Europeans, only 49% spent more than an average value of 100+ Euros ($106) or more.

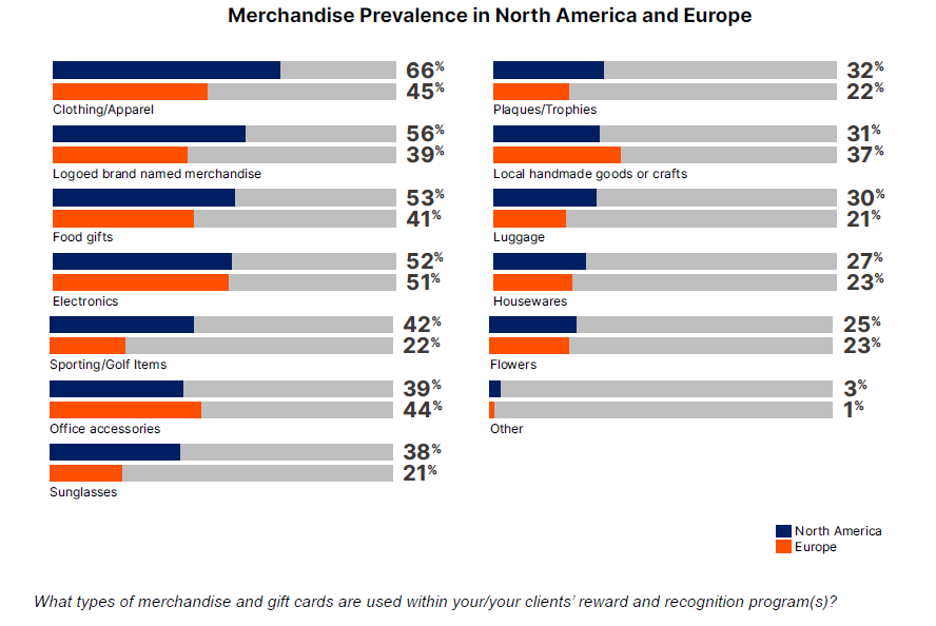

In North America, apparel (66%), logoed brand merchandise (56%) and food gifts (53%) are the most popular choices, roughly consistent with the 2021 study except for the following items, which showed the largest increase in prevalence:

- Clothing (66% in 2022, up from 50% in 2021)

- Sporting goods (42%, up from 29%)

- Food gifts (53%, up from 43%)

Gift card spending looks strong. After some decline in gift card spending after the pandemic, gift card spending has rebounded significantly in the past year within North America. Forty-six percent of North American respondents report spending more on gift cards, with only 15% spending less. This result is consistent with a separate study conducted in summer 2022 by the Incentive Federation that showed a 47% increase in gift card spending for employee incentives, with only 11% spending less.

European respondents also indicate an increase in gift card spending in 2022, with 36% reporting increased gift card spending and 19% reporting decreased spending. This is a big turnaround from 2021, when only 24% of Europeans increased gift card spending and 46% spent less.

Looking ahead to 2023, North American respondents anticipate a continued net increase for gift cards, with 62% anticipating an increase and only 12% predicting a decrease. Europeans also plan to raise their gift card budgets in 2023, although the net increase will not be quite as large; half (50%) of Europeans say they expect to increase their gift card spending, while 19% plan to decrease gift card spending.

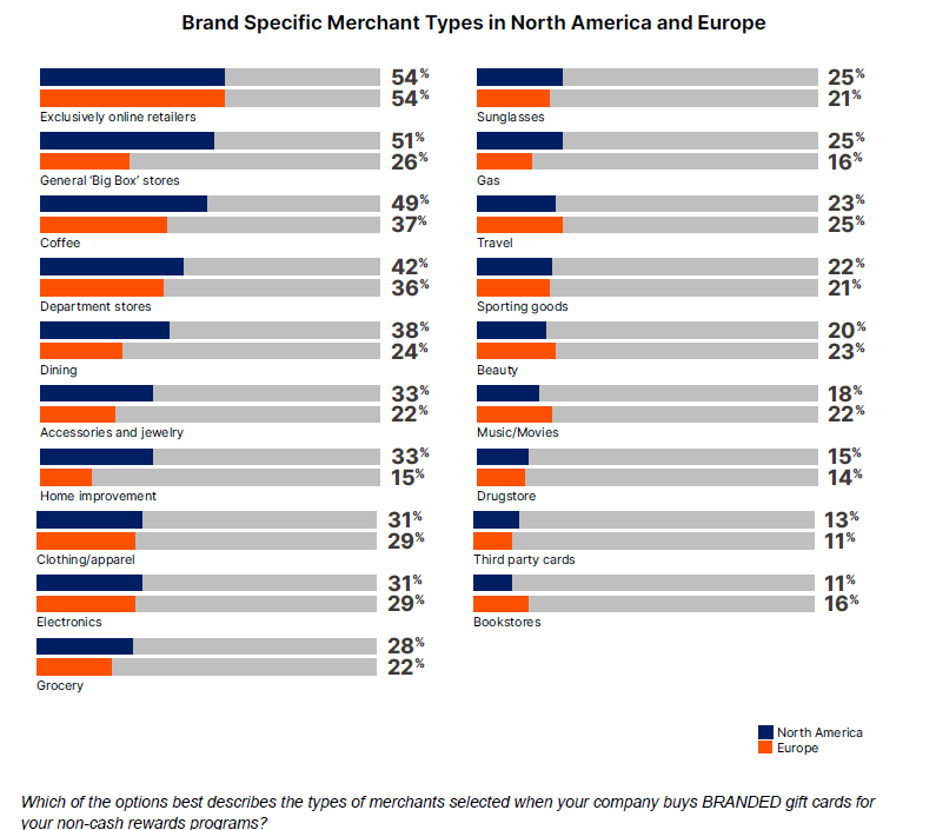

Relative to specific gift card types, online retailers which showed a decline in 2021, rebounded from 39% to 54% in North America. ‘Big Box’ retail cards also jumped from 39% to 51%. Like North America, online retail cards showed the biggest growth in Europe, going from 45% to 54%. Coffee gift cards and department store cards also show growth, ranking second and third as the most frequent gift card categories in Europe. North Americans are significantly more likely to utilize ‘Big Box’ retail cards, coffee, dining, gas, and home improvement cards than Europeans.

Event gifting on the rise. In 2022, the average per-person spend increased to an average of $263 and a median of $100. This is up from 2021, when the average was $96 with a median expenditure of $50 per attendee. In 2019, respondents reported spending an average of $213 per attendee with a median spend of $100. European spending per attendee was slightly less than North America at an average spend of 221 Euros ($235) and a median spend of 100 Euros ($106).

- Local gift relevance and being ‘on topic’ for the event decline in importance.

- Event gifting is up for internal meetings (from 43% in 2021 up to 54% in 2022) and product launches (from 29% up to 36%).

- The types of gifts given at North American events did not change significantly from 2021 to 2022, with nationally recognized brand merchandise being the most prevalent. In 62% of instances, brand name merchandise was used.

- Gift distribution methods in North America did not change significantly since 2021, with ‘swag bags’ given at the registration desk remaining the most popular means of distributing event gifts.

Profit From the “S” of Environmental, Social, Governance (ESG)

Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports boards, business analysts, the C-suite, management in finance, marketing, sales, human resources and operations, etc., educators, students and engagement solution providers seeking a competitive advantage by implementing a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and RRN media services.

1. Professional Education on Stakeholder Management and Total Rewards

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports boards, business analysts, the C-suite, management in finance, marketing, sales, human resources and operations, etc., educators, students and engagement solution providers seeking a competitive advantage by implementing a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and RRN media services.

1. Professional Education on Stakeholder Management and Total Rewards

- Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources.

- The only education and certification program focusing on Stakeholder Engagement and Human Capital metrics and reporting, featuring seven members-only training videos that provide preparation for certification in Enterprise Engagement.

-

EEA books: Paid EEA participants receive Enterprise Engagement for CEOs: The Little Blue Book for People-

Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

- ESM at EnterpriseEngagement.org, EEXAdvisors.com marketplace, ESM e–newsletters, and library.

- RRN at RewardsRecognitionNetwork.com; BrandMediaCoalition.com marketplace, RRN e-newsletters, and library.

- EEA YouTube Channel with over three dozen how-to and insight videos and growing with nearly 100 expert guests.

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

- Association of National Advertisers Brand Engagement 360 Knowledge Center to educate brands and agencies.

- The EEA Engagement widget to promote, track, and measure customers/employee referrals and suggestions that can be connected to any rewards or front-end program management technology.

- The Stakeholder Capitalism free insignia to promote a commitment to better business.

- The BMC Brand Club and transactional storefronts to educate corporate and agency buyers on the IRR market.

- The EME Gold program to educate the top 3% of promotional consultants on selling engagement and rewards services.