Incentives, Recognition, Rewards 2024 Market Report: No Big News Is Good News

Incentive Research Foundation 2024 Trends Report: Business Up, Inflation, Supply Chain Issues Linger

SITE: Annette Gregg, CEO, SITE & SITE Foundation: More Experiences, Teambuilding

Incentive Marketing Association--Jim Atten, President, and Vice President of Client Success, Wolfe, LLC: Opportunity for International Networking

Citizen Watch America--Adrienne Forrest, Senior Vice President: Timepieces Are Hot

ProAm Golf, Ryan DeGrand, Principal: Golf Rebound Continues

Links Unlimited, Scott Kooken, President: Business Is Up Across the Board

Macy’s: Yesha Bansal, Senior Manager, Stores Strategy: A More Holistic Approach

Power Sales, Dave Roberts, Principal: Every Sector Is Growing

Pulse Experiential Travel, Marc Matthews, CEO: A Focus on Experiences, Flexibility, Sustainability

Seiko, Jeffrey Brenner: The Younger Generation Embraces Watches; More Focus on Meaning

Totus, Hollis Thornton, CPIM, Vice President, Client Success: More Consolidation in Gift Cards

Click here for links to RRN Preferred Solution Providers.

This year is shaping up to be another year of double-digit growth for many merchandise, gift card, and fulfillment companies active in the US incentive, rewards, and recognition market. In addition to reviewing industry market reports, RRN checked in with management at suppliers in different sectors of the market.

Most notable trends: Based on an analysis of all the reports and input, we see general across-the-board growth in points-based incentive, recognition, and loyalty programs and corporate gifting. New online recognition and gifting players are creating new opportunities for suppliers and competition for non-digital players, and many industry players are investing in technology. Event gifting has spread to many industries beyond casinos, where some consolidation may be occurring. The interest in experiences and personalization remains on the rise in both travel and merchandise, and there is more growth from promotional distributors, but probably not commensurate with the opportunity as many distributors continue to sidestep the incentive, rewards, and recognition market. Sustainability is an increasing issue in both travel and merchandise.

Here are excerpts from industry reports and interviews with industry suppliers.

Incentive Research Foundation 2024 Trends Report: Business Up, Inflation, Supply Chain Issues Linger

According to the 2024 Incentive Research Foundation Annual Trends Report, the incentive industry continues to see strong performance even as post-pandemic volume pushes start to level out. The demands of a changing workforce are creating increasing demand for incentive professionals to boost engagement, build company culture, and motivate improved performance. As we enter 2024, incentive professionals are called upon to transform incentive programs with new rewards and experiences in a challenging economic environment.

Healthy gains in merchandise, gift cards and event gifting. The Industry Outlook for 2024 reports a net increase of 37% for budgets for merchandise, gift cards, and event gifting in North America. Growth is projected through 2025 for both the number of people participating in incentive trips as well as per-person spend, according to the 2023 Incentive Travel Index. However, these budget increases often do not keep pace with inflation.

Inflation and economic pressures are a top concern across the industry. The 2023 Incentive Travel Index reported that 76% of respondents indicated rising costs and inflation as a challenge. While incentive program budgets are increasing, prices are often rising at a faster pace. Budgets are often increased to maintain a program, and do not indicate incentive program growth.

Inflation concerns impact nearly every industry player in differing ways. Merchandise and gift card rewards are constrained by inflation and rising costs; the increase of only $30 for the per-person spend for rewards reported in the Industry Outlook for 2024 does not allow for significant growth. And for travel incentives, rising costs for hotel, air, and food and beverage – which comprise 65% of the average incentive trip – will continue to squeeze out dollars allocated to inclusions, gifting, and DMC services.

Incentive and recognition programs that utilize points, gift cards, and spiffs meet the need for frequent feedback and rewards. Technology platforms that increase the speed of feedback, amplify congratulatory messaging, and simplify delivery of rewards keep young workers engaged. And the industry is responding with 53% of third parties reporting they are increasing their spending on incentive program technology in 2024, according to the Industry Outlook for 2024.

Program owners are paying close attention to the rewards that motivate younger workers...Younger workers are drawn to merchandise (electronics, etc.) and experiences (concerts, etc.). Younger workers are more likely than others to prefer incentive group travel, and those who have experienced incentive group travel are significantly more likely to prefer it as a reward choice.

Incentive travel on the rise. Incentive travel is up, with 59% of end users and third parties surveyed for the 2023 Incentive Travel Index indicating per-person spend in 2024 will be above 2022 levels. Incentive travel needs to be memorable, and planners are developing strategic and creative ways to design unique experiences at exciting, new destinations while living in the budget / inflation paradox.

There is a strong drive within organizations to utilize destinations that are new to their group, with 71% of respondents to the 2023 Incentive Travel Index citing this as a priority. North American buyers reported that they have not used Oceania, Alaska, and South Asia, but that they are open to considering these new destinations. When working with new destinations and off-the-beaten path locations, planners have noted that incentive-level standards must be maintained, and using unique destinations cannot come at the expense of luxury.

Gift cards. The utilization of gift cards is on the rise, both in terms of volume and the variety of options available. Given their flexibility, broad appeal, boundless choice, and ease of distribution, gift cards will remain a top reward in 2024. According to the Industry Outlook for 2024, the use of gift cards in incentive and reward programs will see a net increase in 2024 spending of 42% in North America and 37% in Europe.

Gift cards for fun and enjoyable purchases (hedonic) and gift cards for everyday purchases like groceries (utilitarian) are both valued by employees. Employee preferences for gift cards demonstrate that cash is not king. The IRF’s survey of 939 North American workers revealed that gift cards (hedonic and utilitarian) were even more preferred than cash rewards.

Event gifting. North American and European stakeholders alike expect continued increases in merchandise rewards in 2024. But we’ll see more event gifting than gift baskets delivered to employee’s front doors. While programs pivoted to merchandise rewards during the pandemic, the return of incentive travel and meetings has impacted how merchandise is used as an incentive and reward.

Personalization. Data-driven program owners are using employee preferences and participant data to deliver merchandise that motivates and inspires. One size does not fit all, so the keys to success are curation, customization, individualization, and presentation. With an eye on making the recipient feel truly rewarded, program owners are focusing on customized and personalized merchandise rewards.

SITE: Annette Gregg, CEO, SITE & SITE Foundation: More Experiences, Teambuilding .jpeg)

The incentive travel sector made a dramatic recovery following the pandemic, with some regions (though not Asia) getting back to 2019 levels already by the end of 2022. In many regions, 2023 produced record revenues for agencies, destination management companies, hotels, and venues, but supply chain challenges continue and are expected to last well into this year. Other headwinds for 2024 are rising costs inflation and short-term planning cycles.

In terms of destination selection, the 2023 ITI (Incentive Travel Index, a joint industry study) reveals a robust preference among buyers for ‘destinations not used before,’ good news for second and third-tier destinations that can now expect to enter the consideration set. Urban destinations, eschewed during the pandemic, continue to rank low for incentive travel buyers while demand for resorts, particularly all-inclusive resorts, is at an all-time high.

While trans-continental travel has resumed, it’s decisively risk-averse and cautious and is consolidated around tried-and-tested destinations. And despite the prominence of “new” destinations in the consideration set, these are nearby, local, national, or regional locations, as opposed to long haul.

More event interactivity. Buyers are increasingly relying on elements such as group meals and teambuilding to reinforce company culture and foster relationships between participants and the C-suite. Sustainability is also increasing in importance as a key program inclusion, but more amongst European Union than North American planners.

As we enter 2024, corporate buyers are telling us that incentive travel is acquiring a more strategic role and purpose within their organizations. It’s increasingly more than a mere company trip in fulfilment of a sales campaign, and more an annual opportunity to focus on company culture and values.

Technology will continue to insinuate itself into the daily routine of incentive travel professionals in 2024 and beyond, although the 2023 Index shows little appetite among incentive travel professionals for AI, with only 7% expecting platforms like ChatGPT to disrupt incentive travel marketing and communications.

The spend per head on incentive travel will increase over the next three years, with 58% of ITI respondents predicting a level above, or significantly above, 2022 spending by 2025, versus 9% who forecast that spending will be below or significantly below 2022 levels.

As for other costs, 64% of ITI respondents are predicting an increase, or a large increase, in airfares by 2025. On the other hand, production levels for incentive events and gala dinners may also fall, with 6% of respondents forecasting a large decrease versus 4% who see an increase.

Incentive Marketing Association--Jim Atten, President, and Vice President of Client Success, Wolfe, LLC: Opportunity for International Networking .jpeg)

We are still seeing an increased emphasis on incentives for engaging and motivating a distributed workforce. This pairs with a growing interest in technology and streamlining tech strategies to improve the employee experience for the employees and increase efficiencies for program managers.

Going into 2024, incentive buyers are slightly less price-sensitive and budgets are more flexible than they were during 2022 and 2023 when inflation worries and a potential recession were talked about in almost every news headline.

The Incentive Research Foundation’s (IRF) new 2024 Trends Report (see above) highlights the growing tension between program planners and suppliers due to increased prices, reduced availability and other factors. It is during times like these that the power of the Incentive Marketing Association member network shines. Our member network helps reduce the tension between suppliers and program planners/buyers. Through the IMA, our members build relationships across every sector of the marketplace, and this gives us ready access to products and services provided by members in the US, Brazil, Europe, the Middle East, Africa, Asia Pacific, and more.

Citizen Watch America--Adrienne Forrest, Senior Vice President: Timepieces Are Hot

Our sales are way up, even in the mid- to higher price points. We are getting more opportunities for larger programs at higher price points. I think this is explained by the fact that we have such a broad array of styles and brands that appeal to everybody. We’re also benefiting from the continued popularity of our automatic watches across all our brands, as well as our eco-drive, which speak to our pledge to support sustainability.”

In our Citizen brand, we have a new collection called Tsuyosa with bright colored dials and faces, which is a big trend. As soon as we get them in, they are sold out. Also noticeable is the trend toward smaller watch faces. Unisex styles seem to be back in demand. The brand’s growth can also be attributed to the buzz created by partnerships with celebrities such as Marc Anthony, the company’s expansion into jewelry, and the opening of its new Citizen Watch America flagship store, just steps away from Rockefeller Center on Fifth Avenue in New York City.

What’s noteworthy this year in the corporate market is the striking growth in our company’s event gifting business. Citizen not only does business in the casino market through our marketing partners but works with meetings and incentive travel companies and promotional products distributors supporting the corporate events marketplace across all industries.

Also a source of growth this year is loyalty and performance points programs. We saw double-digit growth last year, especially in online catalogs, and this category continues to grow.

ProAm Golf, Ryan DeGrand, Principal: Golf Rebound Continues

Business was up in 2023, and we expect that pace to continue. Golf is growing. Rounds of golf are way up. Just when people thought a few years ago that golf was in decline, almost every club in the St. Louis area where we are located is doing well. Simulators have become huge. More people are playing in their homes, their basements, in their garages, or at local golf centers. Prices for these units range anywhere from $500 to $25,000, and they make a great incentive, gift, or promotion.

One big change in golf is that the leading brands are now going after every price point. It used to be that some brands specialized only in high end clubs—now the leading brands are coming out with something for just about everybody. So, there might be three drivers retailing for $599, $449, and $299, all from the same brand.

Our event business made a big comeback last year and continues to get stronger, as does our business with incentive, recognition, and loyalty companies.

Links Unlimited, Scott Kooken, President: Business Is Up Across the Board

Last year was overall a good year with a strong fourth quarter, and 2024 appears to look promising as well. We are doing well across all our businesses, including our promotional products division (which sells only retail brands through distributors); decoration; loyalty; points-based incentive and recognition programs, and third-party logistics that manages mainly retail fulfillment. A key to growth is onboarding new brands. Although the supply chain issues are mostly gone, there is much more concern about logistics, freight, labeling and new regulations, including sustainability for our European brands. Customers are increasingly focused on these issues.

Macy’s: Yesha Bansal, Senior Manager, Stores Strategy: A More Holistic Approach

In 2023, as compared to years before, when it comes to gifting, or rewarding the client, the industry is realizing that it cannot operate in silos. There needs to be an integrated, end to end holistic approach to engaging the client, and ultimately creating the delight points, the right rewards for loyal clients. We work across various sectors and industries. While there is organic growth in the employee recognition sector and in financial reward programs, the travel and gaming industry rewards space too has shown significant growth.

The local brands, be it for travel or gaming, are getting consolidated under larger umbrellas. Earlier there was a very regional, local approach to incentivizing high spenders or attracting new clientele. In 2023, we saw more threads tied up together with a better targeted strategy and clearer approach. While it has its upsides on better operations, the local flavor does get diluted a bit.

Technology in the incentive space will remain a factor that makes this space more agile and is a reason for its continuous evolution. There is so much more to do. As we know our customers better, the more personalized and meaningful the incentive becomes. It’s exciting to be in an industry which is forever in the discovery stage of its life cycle, with only more delight to untap and discover.

Power Sales, Dave Roberts, Principal: Every Sector Is Growing

Last year was up by double digits, and we expect to continue that trend this year. Our business appears to be up across the board, including with the companies that handle incentive, recognition, and loyalty points program, promotional distributors, and with new accounts in the online gifting and incentives arena. Our inhouse decoration business, which averages about 5 to 10% of our volume, continues to grow at the same rate as our overall business. I attribute the growth to increased market share as well as new business by sticking to our knitting—stocking the brands that people want and competitive pricing with a focus on continuously improving our systems and technologies for greater efficiency and turnaround. Because we only sell through companies that sell to end-users, it’s difficult to know the types of programs growing the most, but it stands to reason that there’s an emphasis on employees because of the continued retention and hiring issues.

Pulse Experiential Travel, Marc Matthews, CEO: A Focus on Experiences, Flexibility, Sustainability .jpeg)

The growth we experienced during the pandemic when many group travel programs were cancelled or postponed continues. It seems clear that companies are spending more to motivate and reward people that are important to their organizations, employees, customers, channel partners. We are experiencing growth across the board. As most of the industry studies indicate, individual travel is as popular as ever. There no doubt is a greater interest in experiences, both outdoors and cultural, as well as on eco-travel. This is why we added this year a new line of eco-travel experiences. Also increasingly important these days is flexibility. In addition to giving people two years to redeem their certificates, we now enable people to gift a Pulse Experiential Travel award they might have received to someone else in their family or business.

Seiko, Jeffrey Brenner: The Younger Generation Embraces Watches; More Focus on Meaning.jpeg)

We had a strong 2023 and trends show continued growth for 2024. Important caveat, when in an election year, markets can tend to be conservative, and consumers follow suit. We are seeing a continued interest in premium, luxury goods through increased volume in those models that resemble our luxury pieces, aspirational. No matter the generation, the interest in traditional timepieces has been substantial. It’s interesting that a younger generation finds automatic movements of particular interest; the technology intrigues them. Consumers are focused on nostalgia, something a watch can communicate.

The changing landscape of the remote workforce and the need for companies to be creative and focused to retain talent is driving growth. Our industry will be a significant presence in providing reward and recognition solutions to assist them with this task, within both their sales and HR organizations.

Industry growth also will come from new technologies; how, where and with what device to select a reward and be recognized. AI will have a place specifically in providing a deeper understanding of the employees' and consumers' preferences and habits. Additionally, on-site gifting and experiential travel events will see significant growth for national sales meetings, key performance recognition trips, board retreats and all other meeting-related activities.

One unique trend happening now is that many companies that had focused 100% on casinos are now including gifting to their offering/platform for all industries. This provides additional growth for suppliers/brands. Also new, innovative technologies offer and deliver Incentives to consumers quickly and provide “experiences.” It is fun to be incented, then rewarded.

On-site event gifting remains strong, with end-users looking for merchandise that is not only trendy or doing well at retail but can offer an experience in tandem with the actual gift. Many companies also want a product that is doing good for the environment and human beings. Cause-based experiences are key, from both product and travel rewards; recipients want unique and different with a purpose.

Hollis Thornton, CPIM, Vice President Client Success, Totus: More Consolidation in Gift Cards.jpeg)

From a gift card industry perspective, we will continue to see service provider consolidation in our industry as large aggregators are looking to diversify – with the objective of becoming stickier with existing customers and finding new customers by providing new channel solutions. In addition, we are continuing to see new use cases pop up, with organizations entering the US market from other countries and new organizations starting up to solve new technology needs. Recent examples include the ability for on-the-spot gifting through platforms like Salesforce or Teams

Profit From the “S” of Environmental, Social, Governance (ESG)

Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports boards, business analysts, the C-suite, management in finance, marketing, sales, human resources and operations, etc., educators, students and engagement solution providers seeking a competitive advantage by implementing a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and RRN media services.

1. Professional Education on Stakeholder Management and Total Rewards

- Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources.

- The only education and certification program focusing on Stakeholder Engagement and Human Capital metrics and reporting, featuring seven members-only training videos that provide preparation for certification in Enterprise Engagement.

-

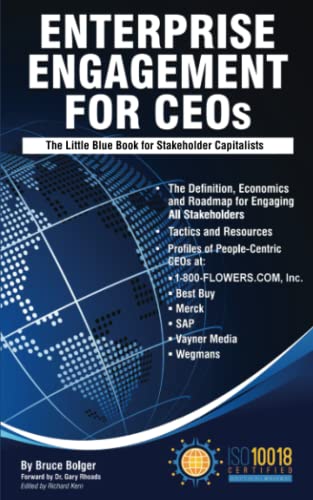

EEA books: Paid EEA participants receive Enterprise Engagement for CEOs: The Little Blue Book for People-

Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

- ESM at EnterpriseEngagement.org, EEXAdvisors.com marketplace, ESM e–newsletters, and library.

- RRN at RewardsRecognitionNetwork.com; BrandMediaCoalition.com marketplace, RRN e-newsletters, and library.

- EEA YouTube Channel with over three dozen how-to and insight videos and growing with nearly 100 expert guests.

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

- Association of National Advertisers Brand Engagement 360 Knowledge Center to educate brands and agencies.

- The EEA Engagement widget to promote, track, and measure customers/employee referrals and suggestions that can be connected to any rewards or front-end program management technology.

- The Stakeholder Capitalism free insignia to promote a commitment to better business.

- The BMC Brand Club and transactional storefronts to educate corporate and agency buyers on the IRR market.

- The EME Gold program to educate the top 3% of promotional consultants on selling engagement and rewards services

.jpg)